On February 24, 2014, the Nasdaq Stock Exchange made public its decision to delist the common shares of Hauppauge Digital (HAUP) from its exchange as it no longer met the qualification criteria. On July 28, 2014, the SEC accepted Hauppauge Digital’s application to go dark, as the company had less than 300 shareholders.

Hauppauge Digital last annual 10K filing was for 2013, where the company posted revenues of $34 million. At its peak in 2008, Hauppauge generated over $100 million in annual revenues. Hauppauge’s last filing before going dark was a 10Q filed in May 2014. At that time, the balance sheet showed a negative book value of $3 million.

When Companies Go Dark

Having its common stock publicly listed requires companies to prepare and make public regular filings to the Securities Exchange Commission (SEC). For small (and shrinking) companies, these filings can become a significant burden on their limited resources.

When companies request to voluntarily terminate the registration of their stock with the SEC, they file a certain SEC Form 15 and notify the regulator of its intention to stop filing certain regulatory filings. A company must have less than 300 registered shareholders to be able to file an SEC Form 15 and go dark.

Although going dark is usually a bad indicator for the prospect of a company, it does not automatically mean the end for the company. There do exist cases where going dark was simply a prudent decision from management to minimize costs and going dark does not mean that a company has to stop communicating with their shareholders. Winland Holding is an example of a company with good corporate governance and communication to shareholders, despite going dark.

Hauppauge Goes Dark

Hauppauge is no Winland Holdings. Once Hauppauge went dark, the company completely shut off to outside investors. Some investors have had encounters with the management of Hauppauge, requesting access to the company’s annual report. Even though this as is the right of shareholders under both New York and Delaware law, management has vehemently refused to hand over any such information.

Despite the silence from management, there is a reason to believe that there might still be value lurking in the darkness. Hauppauge is actively selling their products on Amazon and on their own, recently renewed, website.

Who Are Hauppauge’s Creditors?

Looking at the balance sheet of Hauppauge’s last filing, it is apparent that the majority of liabilities are from suppliers of the company, who would, in theory, have more reason to keep the company afloat than other creditors.

One the largest item under liabilities are “accrued expenses-fees”. In the notes, to the latest annual report, these liabilities are described as “related purchase or license agreements provide for payment of royalty and other fees associated with our sale of the related products. Such fees are estimated and get accrued and reflected as a component of cost of sales when those sales occur. In certain circumstances, such fees are not specifically covered by contractual arrangements but are nonetheless potentially due to the third party sellers or owners of the software and technologies.”

After doing some digging, you would find that in 2008, Hauppauge purchased the Pinnacle PCTV product line from Avid Technology. It is not unlikely that Avid Technology is entitled to retroactive license fees based on Pinnacle related sales. This could also apply to various other suppliers of technological components of Hauppauge products.

But Is There Value in Hauppauge Stock?

Currently, the Hauppauge stock is trading over-the-counter at around $0.05 to $0.09 per share, with a market capitalization of under $1 million. At its peak, Hauppauge traded briefly for over $24. To determine if there is truly value there, it is worth taking a closer look at the companies online efforts.

Hauppauge has around 200 thousand visits per month on its hauppauge.com website. This does not include traffic to their sites in other languages, such as German. Hauppauge.de has around 75 thousand visits a month and hauppuage.co.uk has around 65 thousand visits a month.

If you look at the source of this traffic, most of the traffic is actually coming from organic searches and direct traffic:

According to various sources, there are more than 600 external domains linking to hauppauge.com. Some of these domains have a relatively high authority score.

Most of the traffic to their main website from social media comes from the Hauppauge Youtube channel.

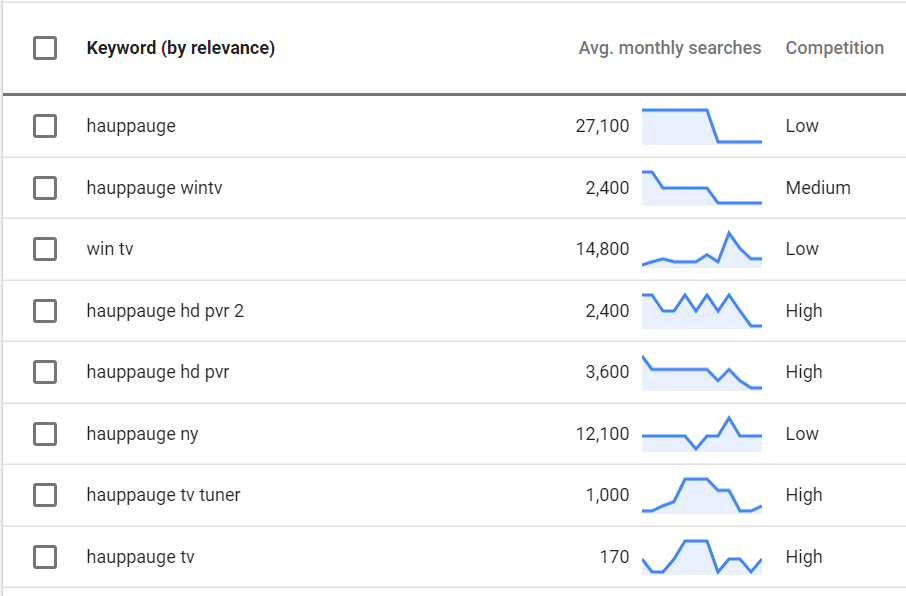

When looking at search volumes on Google, over the last 12 months, 27,100 searches were made on average per month for the query “hauppauge”. This indicates that they Hauppauge brand has material brand value.

When looking at search volumes on Google, over the last 12 months, 27,100 searches were made on average per month for the query “hauppauge”. This indicates that they Hauppauge brand has material brand value.

Domain Authority is a search engine ranking score developed by Moz that predicts how well a website will rank on search engine result pages. A Domain Authority score ranges from one to 100, with higher scores corresponding to a greater ability to rank. The hauppauge.com has a very high domain authority score of 61.

Searching for Hauppauge on youtube.com will deliver more than 360 thousand results.

And a visit to the Hauppauge Youtube channel reveals that the company has over 11 thousand subscribers to its channel.

The Big Red Flag

There is no denying that there is activity under Hauppauge. The company is actively developing selling products and has been investing in developing its website as a sales channel as well.

However, it was on the Hauppauge Digital page on Glassdoor.com where a significant red flag was discovered. In a post from March 2018, a former employee of more than 10 years disclaims that the company has been dissolved and the assets moved to a new business.

Scavenger hunts can lead you to find that rare diamond in the rough. Most of the time, however, the rough turns out to be just rough.

The Fundamental Finance Playbook is a publication dedicated to the Fundamental Research of Stocks and Security Analysis. We publish thoughts and opinions on individual publicly traded stocks as well as our thinking on methodologies for finance and investing practices in general.

All publication on the Fundament Finance Playbook is provided for informational and entertainment purposes only and does not constitute a recommendation to any particular security, a portfolio of securities, or an investing strategy.

Other Stock Writeups